|

|||||||||

|

|

||||||||

Vancouver, BC – TheNewswire – January 18, 2023 – Global Energy Metals Corporation (TSXV:GEMC) (OTC:GBLEF) (FSE:5GE1) (“Global Energy Metals”, the “Company” and/or “GEMC”), a multi-jurisdictional, multi-commodity critical mineral exploration and development company focused on growth-oriented battery metal projects supporting the global transition to clean energy, is pleased to announce that it has entered into a transaction implementation agreement (Transaction Implementation Agreement) with Kingsrose Mining Limited (“Kingsrose”) and Scandinavian Resource Holdings Pty Ltd (“SRH”) for Kingsrose to make a staged investment into the brownfield Råna Nickel-Copper-Cobalt (Ni-Cu-Co) project (the “Project”) and formation of a joint venture for the development and operation of the Project (the “Transaction”).

Highlights

-

The Råna project has proven potential for discovery of massive sulphide Ni-Cu-Co mineralisation and is underexplored using modern deposit models and exploration methods.

-

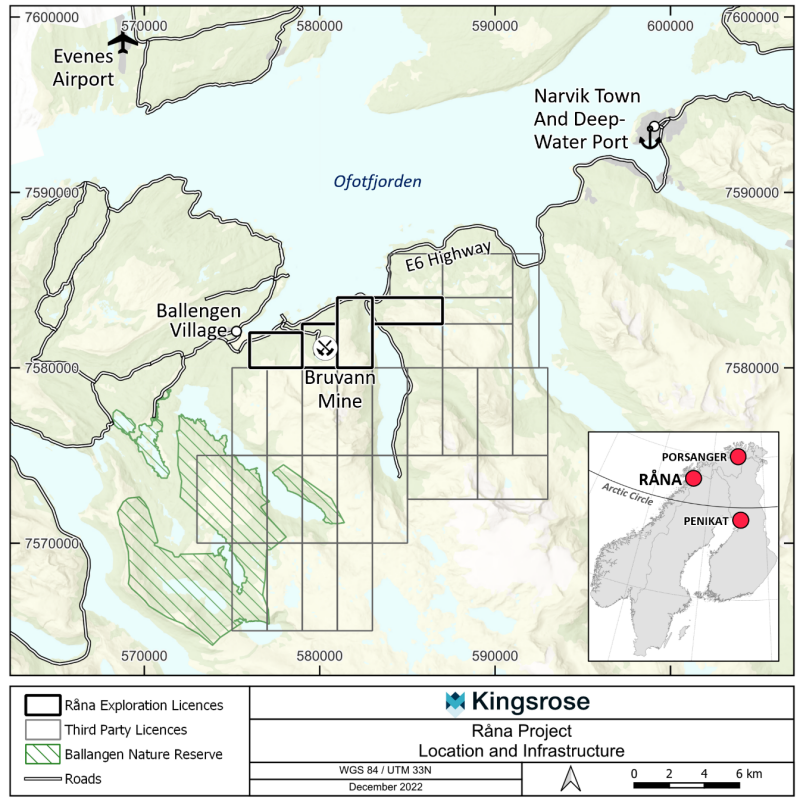

Excellent access to local infrastructure, located 37 kilometres by main road from the ice-free, deep-water Port of Narvik in Nordland County, Norway.

-

The project includes the past producing, underground Bruvann Mine within a contiguous exploration licence holding of 25 square kilometres.

-

-

The Bruvann deposit included a small but high-grade (approximately 1 to 5% Ni) massive sulphide core, indicating that the intrusion generated high tenor nickel sulphide mineralisation.

-

Past production demonstrates the viability of operating in the region and the mine area remains designated for raw material extraction in the municipality land use zoning plan.

-

-

Kingsrose has identified three priority prospects with a focus on exploration for high-grade nickel-copper-cobalt sulphide mineralisation:

-

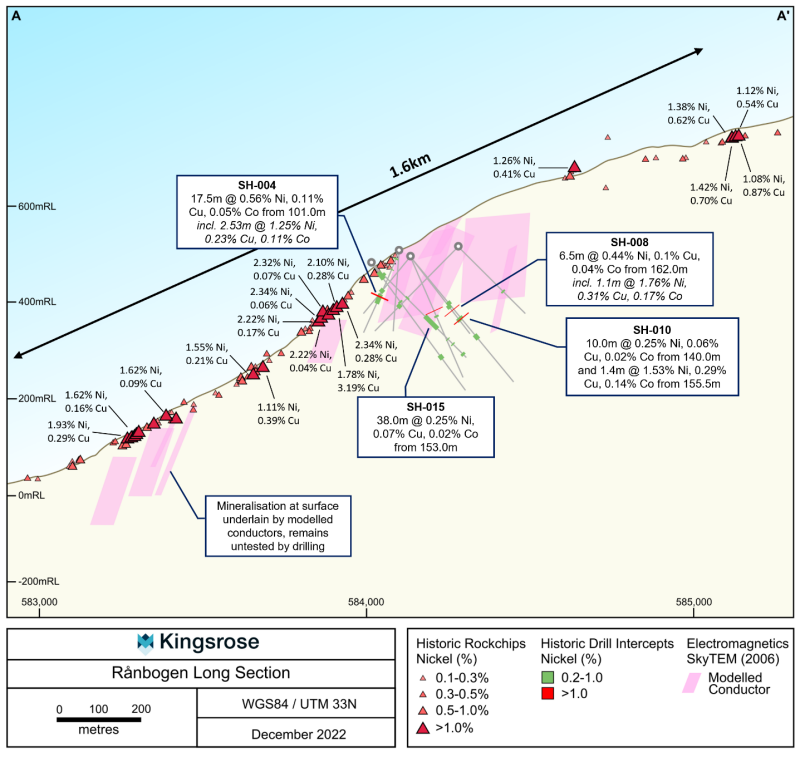

Largely undrilled massive sulphide mineralisation outcrops at surface over a 1.6 kilometre zone at the Rånbogen prospect with historical rock chip samples up to 2.3% Ni and 3.2% Cu

-

Historical (2006) drilling at the southeastern part of Rånbogen returned a best intercept of 17.5 metres @ 0.53% Ni, 0.12% Cu, 0.05 % Co from 101 metres (SH004), including 2.5 metres @ 1.13% Ni, 0.24% Cu, 0.10 % Co and remains open.

-

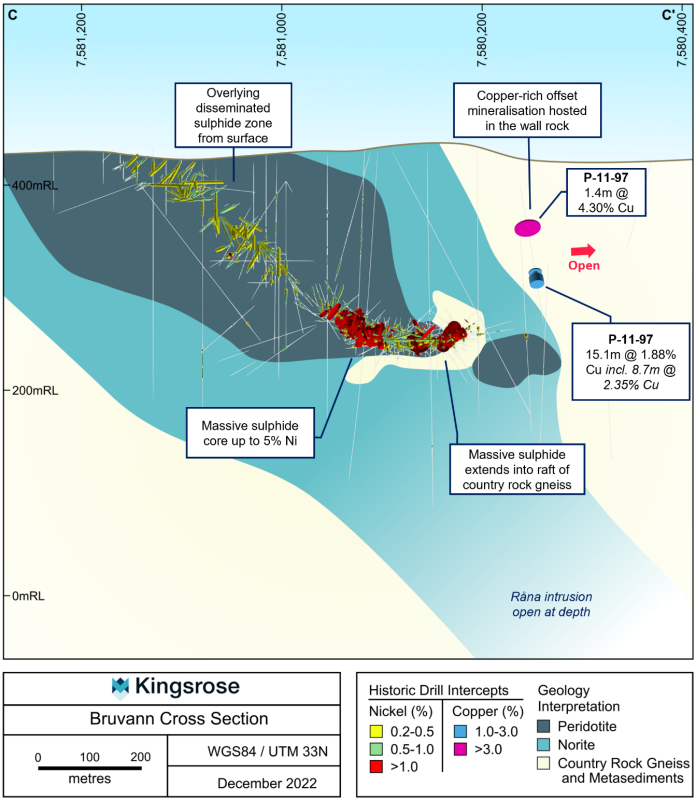

The Bruvann Mine is open immediately along strike from mine workings and is adjacent to a 1km long, undrilled conductive body which may represent massive sulphide mineralisation. Offset styles of copper-rich mineralisation south of the mine are inferred from historical drill data in hole P-11-97 and have never been followed up:

-

15.1 metres at 1.89% Cu from 148.6 metres, including 8.7 metres @ 2.35% Cu from 155.0 metres.

-

-

The prospective basal ultramafic part of the intrusion strikes over 8 kilometres and dips to the southeast within the licence holding. This has never been systematically explored.

-

-

The Transaction Implementation Agreement allows for Kingsrose to earn up to 75% over 8 years, through staged expenditure up to a total of A$15m.

Figure 1: Location of the Rana project and proximity to local infrastructure

Mitchell Smith, CEO and Director of Global Energy Metals commented:

“We are very excited by this development and the significance it has for validating the strategic interest we hold in the Råna project. This agreement provides an opportunity to significantly grow our shareholder’s value through the sole funded and rapid advancement of the Råna project by our new partner Kingsrose Mining. Additionally, we benefit from being aligned with a formidable team that combines Råna’s exploration and development expertise along with extensive jurisdictional knowledge, proven mining experience and success in transacting. We look forward to working with the Kingsrose team in setting a new standard in ‘green exploration and development’ with this partnership.”

Fabian Baker, Kingsrose Managing Director, commented:

“Råna is a very exciting nickel-copper-cobalt sulphide exploration project which complements Kingsrose’s growing critical metals portfolio in the Nordics. Syn-orogenic mafic-ultramafic intrusions analogous to Råna host some of the highest-grade deposits globally, such as Nova-Bollinger and Kabanga. Mineralisation at the Bruvann deposit provides proof of concept that the system is fertile and capable of producing high tenor magmatic nickel sulphide.

Exploration outside of the mine site is very immature, in that modern models of magmatic sulphide deposit formation and exploration techniques have not been applied. Kingsrose sees excellent potential for the discovery of additional high-grade massive sulphide bodies through exploration of the whole intrusive system, with a particular focus on basal and ‘offset’ styles of mineralisation which are common in these settings but have not been explored for historically. We have a focussed exploration program planned to rapidly advance our understanding of the geology and generate targets for drilling later in 2023.

This transaction is testament to our M&A strategy in a market where high-quality nickel sulphide projects are difficult to come by. Nickel is essential in the electrification required to achieve a low carbon future and Europe needs to secure a sustainable domestic supply. With additional funds from the sale of Way Linggo, Kingsrose looks forward to advancing Råna alongside Penikat and Porsanger while continuing the search for additional assets to support Europe’s green energy transition.”

Key Terms of Transaction Implementation Agreement

The Transaction Implementation Agreement provides for the establishment of a new Norwegian joint venture company (“JV Company”) and for Kingsrose to offset expenditure on the Project as consideration for shares in the JV Company. Kingsrose has paid a pre-completion deposit of A$25,000 to SRH, additionally, Kingsrose will make payments in cash and Kingsrose shares to SRH on earn-in milestones as described below:

|

Completion |

Milestone |

Consideration |

|

First (For 10% of shares in JV Company) |

The incorporation of the JV Company with an issued capital of 90,000 JV Company shares with:

SRH and GEMC transfer each of the Exploration Licences to the JV Company, (First Milestone). |

10,000 JV Company shares will be issued and allotted to the Company (First Milestone Shares) on payment by Kingsrose of NOK 140,000 into the capital of JV Company (A$20,300 based on NOK:A$ exchange rate of 0.145). A$30,000 to be paid by the Company to SRH. |

|

Second (For 51% of shares in JV Company) |

Kingsrose (or a related body corporate) (Manager), incurring expenditure of at least A$3 million (minus the Licence Fees Amount) within 3 years from the date of First Completion including not less than:

(Second Milestone). |

94,617 JV Company shares will be issued and allotted to the Company. 10,513 JV Company shares will be issued and allotted to GEMC. 1,000,000 KRM Shares will be issued and allotted to SRH. |

|

Third (For 65% of shares in JV Company) |

Expenditure by the Manager of at least an additional $4 million within 2 years following Second Completion (Third Milestone) |

103,391 JV Company shares will be issued and allotted to the Company. 3,500,000 KRM Shares will be issued and allotted to SRH. $250,000 to be paid by the Company to SRH. |

|

Fourth (For 75% of shares in JV Company) |

Expenditure by the Manager of at least an additional $8 million within 3 years following Third Completion (Fourth Milestone) |

10,000 JV Company shares will be issued and allotted to the Company. A cash payment of $750,000 to be paid by the Company to SRH. |

Completion of the transaction will occur in four stages, with each completion and payment and/or issuance of consideration subject to satisfaction of certain milestones on the terms set out in the Schedule to this announcement.

GEMC shall be free carried to completion of the Second Milestone, thereafter GEMC shall be required to contribute pro-rata (10%) to expenditure on the Project in accordance with a work program and budget to be determined by Kingsrose as Manager of the Project. In the event GEMC elects not to contribute its funding share, Kingsrose has the first right to provide such funding and acquire additional shares in JV Company.

The Project is subject to three net smelter royalty deeds of one percent payable by JV Company to each of GEMC, Electric Royalties Corp., and Chincherinchee Pty. The Transaction Implementation Agreement provides for SRH and GEMC to enter into a right of first refusal deed granting Kingsrose a right of first refusal to acquire the right, title and interest in the Chincherinchee Royalty and the 0.5% buyback option in the GEMC royalty.

Exploration Potential and Work Program

Initial field observations by Kingsrose indicate that Råna is a mafic-ultramafic chonolith comprising multiple complex magmatic phases, with internal characteristics that are consistent with a conduit-style of emplacement. The basal ultramafic intrusive units occur mostly at the northwestern part of the intrusion which is controlled by SRH, and is the most prospective horizon for high tenor, massive sulphide nickel mineralisation.

-

Kingsrose interprets the mineralised intrusions at Bruvann and Rånbogen to be chonoliths forming part of a larger, multi-phase intrusive complex. Chonoliths are pipe like intrusions which may have short lateral but long down dip continuity.

-

Massive sulphide mineralisation typically occurs at the base of a chonolith and in the immediate footwall as ‘offset’ bodies of massive sulphide mineralisation. Exploration for these styles of mineralisation has not been systematically undertaken historically at Råna and these may be blind at surface, compromising detection by traditional methods.

-

Historical work focused predominantly on near mine exploration of outcropping mineralisation at Bruvann with limited to no application of modern exploration models for chonolith hosted magmatic sulphide deposits.

-

Deep penetrating AMT geophysical surveys are planned to explore for conductive bodies from surface to more than 600 metres deep, which may host massive sulphide mineralisation.

-

Airborne magnetic geophysical surveys will be used to model intrusion morphology.

-

Detailed mapping, core logging and XRF measurements for lithogeochemical characterisation will be used to generate a three dimensional geological model and identify prospective intrusive units.

-

Drilling is expected to commence later in the Norwegian summer.

-

Massive sulphide outcrops with high nickel tenors at Bruvann and Rånbogen demonstrate fertility and, with 8 kilometres of largely untested strike along the northern intrusion margin, Kingsrose considers that there is scope for a significant scale discovery.

Overview of the Project

Location and Tenure

The Råna project is located Nordland County, Norway, 37 kilometres west by road from the town of Narvik and a deep-water, ice-free port which ships approximately 20 million tonnes of iron ore per year from LKAB’s Kiruna operations.

The Project comprises four contiguous exploration licences totalling 25 square kilometres, owned 90% by Scandinavian Resource Holdings and 10% by Global Energy Metals Corp. Net smelter royalties totalling 3% apply to the Project in addition to a 0.5% net smelter royalty under Norwegian mineral law. The licences were granted in January 2019 and are valid through to 2026.

Exploration has been carried out sporadically at the Råna intrusion since at least 1880 when sulphides were discovered in the south at Eiterdalen. Exploration by Stavanger Staal and the NGU in the 1970s and 1980s focused on Bruvann, including 33,769.7 metres of drilling and various ground based geophysical surveys which defined the Bruvann deposit. A private company, Nikkel og Olivin and Outokumpu conducted underground mining at Bruvann from 1989 until 2002, initially through a small open pit and later underground mining. Production is reported to have totalled 8.5 million tonnes at 0.5% Ni, 0.1% Cu and 0.03% Co from approximately 25 kilometres of underground workings, with life of mine recoveries reported as 74% Ni, 85% Cu and 62% Co.

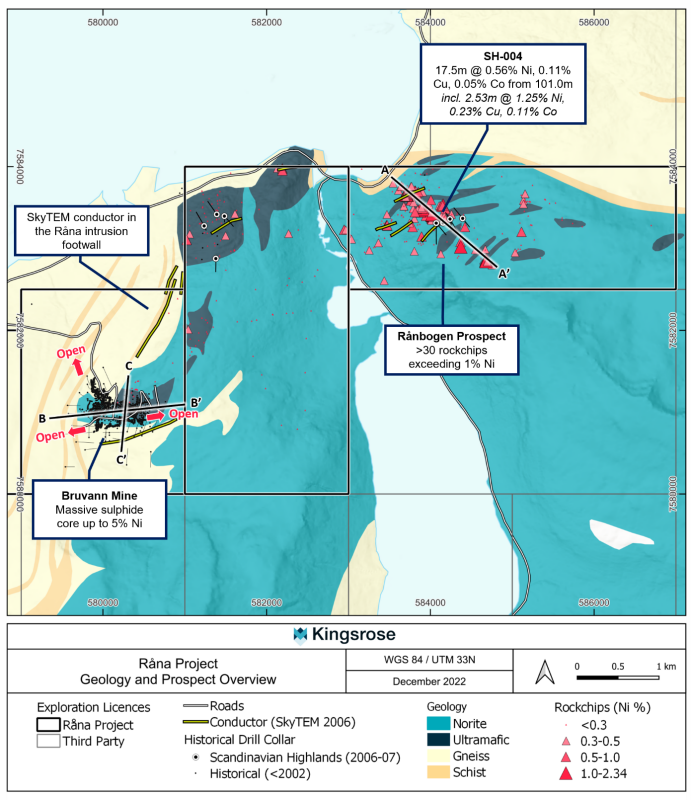

Scandinavian Highlands explored the northern part of the intrusion from 2004-2013, carrying out surface geochemical sampling and a SkyTEM geophysical survey over the whole licence area before testing Arnes and Rånbogen with 16 diamond drill holes for 4,000 metres. The SkyTEM survey identified several strong, near surface conductors at Bruvann, Arnes and Rånbogen, however the effectiveness of this method is limited by the steep topography and only has a depth of penetration of approximately 100 metres below surface.

The Råna mafic-ultramafic layered intrusion outcrops over an area of 9 by 11 kilometres and comprises basal ultramafic peridotite and pyroxenite sills with upper, more mafic and voluminous gabbro norite and quartz norite, dated at 436.7 Ma and emplaced into Cambrian gneisses and argillaceous metasedimentary rocks with localised graphitic horizons.

Mineralisation typically occurs in the basal ultramafic units which host the highest tenor nickel sulphides and outcrop mainly in the northwest part of the intrusion. Sulphide mineralisation is also observed in the upper gabbronorites albeit of lower nickel tenor. Magmatic sulphide is observed at several prospects along the northern margin of the intrusion controlled by SRH, including the Bruvann Mine, Rånbogen and Arnes prospects.

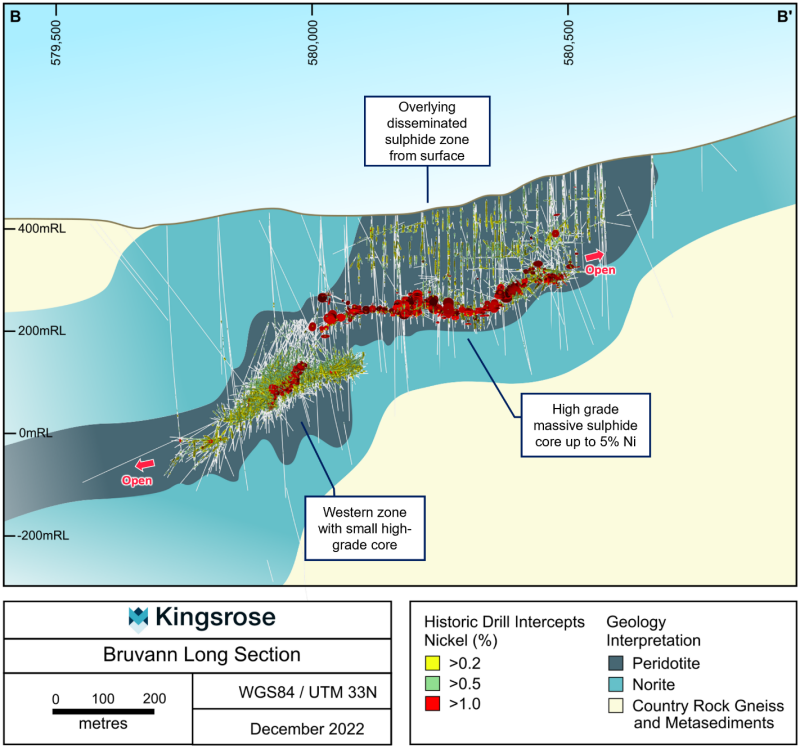

Known mineralisation at Bruvann is largely mined out however historical drill core is available for inspection and provides an important source of information for understanding the controls on mineralisation. Historical drill data indicates that the mineralisation remains open along strike to the west and east, and that a low grade disseminated halo exists adjacent to the mine workings.

Mineralisation occurs from surface and has been drilled to at least 500 metres below surface in the west, where the intrusion and mineralisation is overlain by gneiss. The Bruvann deposit comprised a 10-45 metres thick, peridotite hosted, southwest dipping zone of disseminated sulphide which occurs over a strike of 1,000 metres, overlying a cylindrical, higher grade semi-massive to massive sulphide zone at the contact between peridotite and gneiss. This basal sulphide-rich zone typically exceeded 1% Ni and contained up to 5.87% Ni, with thickness ranging from 2-25 metres, strike of over 500 metres and is inferred to remain open along strike to the east and west. Sulphides comprise pentlandite, sometimes occurring as coarse grains and loops in massive zones, together with pyrrhotite and chalcopyrite.

Offset styes of sulphide mineralisation within the host gneiss are inferred from historical drill data, including an unmined copper rich historical drill intercept immediately south of the mine which remains open, in hole P-11-97:

-

1.4 metres at 4.3% Cu from 94.4 metres and

-

15.1 metres at 1.89% Cu from 148.6 metres, including 8.7metres @ 2.35% Cu from 155.0 metres.

A 900 metre long, east-west conductor is observed at the southern edge of the Bruvann mine and a second, 1.1 kilometre long north-south oriented conductor is observed to the north of the mine. Both conductors are proximal to the mapped contact between the intrusion and gneiss and were historically interpreted as being related to graphitic units in the wall rock. The east-west conductor is immediately adjacent to the mined massive sulphide at Bruvann, and the north-south oriented conductor has never been followed up. Kingsrose considers that the north-south conductor warrants further exploration to test whether massive sulphides are present.

Rånbogen is located 4.5 kilometres northeast of the Bruvann Mine and is defined by a 1.6 kilometre long zone of anomalous nickel-copper in soils which coincides with several mapped ultramafic sills and lenses of outcropping massive and disseminated sulphide mineralisation.

Historical rock chip sampling from this zone includes 30 samples exceeding 1% Ni, with a maximum of 2.3% Ni, coincident with shallow conductors identified by the 2006 SkyTEM survey. In 2006, the southeastern part of the Rånbogen prospect was drilled by SRH with 10 holes totalling 2431.4 metres to a maximum depth of 371.2 metres downhole. There are also two historical holes at the northern part of Rånbogen totalling 664 metres located 200 metres northeast of the mineralised outcrops. Seven holes intercepted disseminated sulphide mineralisation with narrow zones of massive sulphide which remain open (Table 1). However, the orientation of mineralised zones was not well constrained, no follow up drilling has been conducted and the potential extensions to depth have not been adequately explored with appropriate geophysical methods such as AMT (Audio Magnetotelluric) or EM (electromagnetic) surveys.

Table 1: Significant historical drill intercepts from the Rånbogen prospect

|

(%) |

(%) |

|||||

|

||||||

Arnes is located 2.5 kilometres north of the Bruvann Mine and comprises of upper pyroxenite grading into lower olivine peridotite, with irregular zones of disseminated sulphide and rare stringers of massive sulphide. Metal tenor at Arnes is low but historical drilling has intercepted broad zones of anomalous nickel sulphide mineralisation up to 48 metres thick grading 0.25% Ni from 34 metres downhole (SH-009). The base of the intrusion has not been intercepted at Arnes and the area remains prospective for discovery of blind massive sulphide mineralisation toward the base of the conduit.

Table 2: Significant historical drill intercepts from the Arnes prospect

|

(%) |

(%) |

|||||

Figure 2: Rana exploration project

Figure 3: Long section at Rånbogen through A-A’ (Figure 2), viewed east.

Figure 4: Long section at Bruvann Mine through B-B’ (Figure 2), viewed north and showing historical, pre-mining drilling

Figure 5: Cross section at Bruvann Mine through C-C’ (Figure 2) viewed east and showing historical, pre-mining drilling.

Figure 6: Massive sulphide in outcrop at Rånbogen where historical rock chip samples up to 2.34% Ni are reported

Figure 7: Historic drill core photos. Top left – massive pyrrhotite-pentlandite with pentlandite occurring as coarse loops (Bruvann BH-265-125, 1m @ 3.08% Ni); Top right – massive pyrrhotite-pentlandite (Rånbogen SH-004, 0.35m @ 2.52% NiS); Bottom left – net-textured sulphides in poikilitic harzburgite cross-cut by soft-walled sulphide vein (Bruvann, DH1061-01, 2m @ 0.7% Ni); Bottom right – massive sulphide vein breccia cutting olivine pyroxenite (Bruvann, BH-265-125, 1.25m @ 1.6% Ni)

About Kingsrose Mining Limited

Kingsrose Mining Limited is a leading ESG-conscious and technically proficient mineral exploration company listed on the ASX. In 2021 the Company commenced a discovery-focused strategy, targeting the acquisition and exploration of Tier-1 critical mineral deposits, that resulted in the acquisition of the Penikat and Porsanger PGE-Nickel-Copper projects in Finland and Norway respectively.

Qualified Person

Mr. Paul Sarjeant, P. Geo., is the qualified person for this release as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Global Energy Metals Corporation

(TSXV:GEMC | OTCQB:GBLEF | FSE:5GE1)

Global Energy Metals Corp. offers investment exposure to the growing rechargeable battery and electric vehicle market by building a diversified global portfolio of exploration and growth-stage battery mineral assets.

Global Energy Metals recognizes that the proliferation and growth of the electrified economy in the coming decades is underpinned by the availability of battery metals, including cobalt, nickel, copper, lithium and other raw materials. To be part of the solution and respond to this electrification movement, Global Energy Metals has taken a ‘consolidate, partner and invest’ approach and in doing so have assembled and are advancing a portfolio of strategically significant investments in battery metal resources.

As demonstrated with the Company’s current copper, nickel and cobalt projects in Canada, Australia, Norway and the United States, GEMC is investing-in, exploring and developing prospective, scaleable assets in established mining and processing jurisdictions in close proximity to end-use markets. Global Energy Metals is targeting projects with low logistics and processing risks, so that they can be fast tracked to enter the supply chain in this cycle. The Company is also collaborating with industry peers to strengthen its exposure to these critical commodities and the associated technologies required for a cleaner future.

Securing exposure to these critical minerals powering the eMobility revolution is a generational investment opportunity. Global Energy Metals believes Now is the Time to be part of this electrification movement.

For Further Information:

Global Energy Metals Corporation

#1501-128 West Pender Street

Vancouver, BC, V6B 1R8

Email: [email protected]

t. + 1 (604) 688-4219

www.globalenergymetals.com

Twitter: @EnergyMetals | @USBatteryMetals | @ElementMinerals

Cautionary Statement on Forward-Looking Information:

Certain information in this release may constitute forward-looking statements under applicable securities laws and necessarily involve risks associated with regulatory approvals and timelines. Although Global Energy Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

GEMC’s operations could be significantly adversely affected by the effects of a widespread global outbreak of a contagious disease, including the recent outbreak of illness caused by COVID-19. It is not possible to accurately predict the impact COVID-19 will have on operations and the ability of others to meet their obligations, including uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of travel and quarantine restrictions imposed by governments of affected countries. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could further affect operations and the ability to finance its operations.

For more information on Global Energy and the risks and challenges of their businesses, investors should review the filings that are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

We seek safe harbour.

Copyright (c) 2023 TheNewswire – All rights reserved.